CEOs Flock to China Amid Rising Trade and Investment Risks

Prominent CEOs from various American companies are currently visiting China to assess the state of one of their key markets following the country's reopening after nearly three years of pandemic-related restrictions.

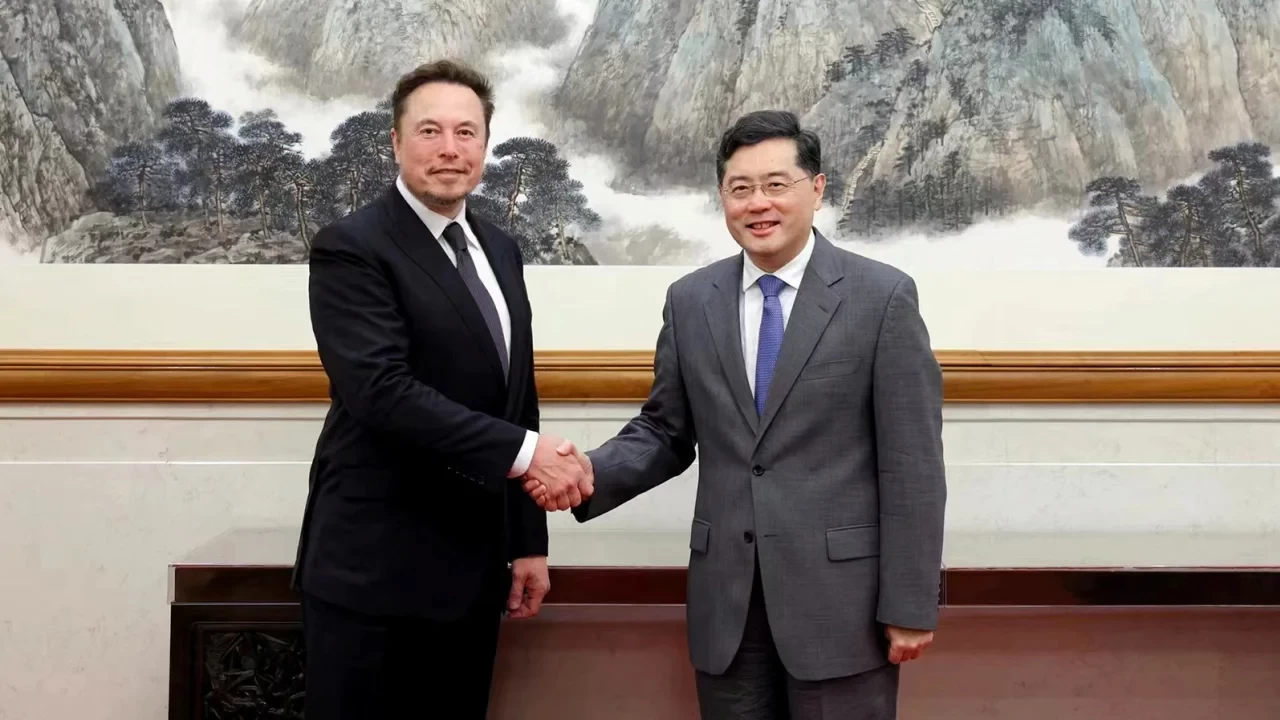

Among the notable figures in town are Elon Musk of Tesla (TSLA), Laxman Narasimhan of Starbucks (SBUX), and Jamie Dimon of JPMorgan (JPM).

These visits come in the wake of several other high-profile visits in recent months, including leaders from Apple (AAPL), Samsung (SSNLF), Aramco, Volkswagen (VLKAF), HSBC (HSBC), Standard Chartered (SCBFF), and Kering.

The presence of these CEOs in the world's second-largest economy underscores China's significance for many blue-chip companies. However, these executives are encountering a more intricate business environment characterized by a crackdown on international consulting firms, geopolitical tensions, and an uncertain investment landscape.

Prior to December, China was largely isolated due to stringent "zero-Covid" measures, leading to increasing calls within the international business community to diversify away from reliance on the country. With those restrictions lifted, an economic recovery in the first quarter began but now appears to be faltering.

In order to boost business, Chinese leaders have encouraged foreign companies to increase their investments in the country, assuring them of an open and fair business environment.

This sentiment was evident on Tuesday when Elon Musk met with China's Foreign Minister Qin Gang, who emphasized the need for a "healthy" relationship with the United States, stating that it was in the best interests of both nations and the world.

Musk supported this viewpoint, expressing that Tesla was against the concept of "decoupling" from China. He was quoted by the foreign ministry as saying, "The interests of the United States and China are intertwined like conjoined twins." Additionally, Musk stated that the relationship between the two countries was not a zero-sum game, emphasizing that one side's gain did not necessitate the other's loss, as reported by China's commerce ministry.

Tesla did not provide a comment regarding Musk's visit, and the billionaire's Twitter account remained unusually quiet following his arrival.

Recently, Tesla has been on the defensive, cutting prices in response to losing market share to competitors in China, such as Warren Buffett-backed BYD (BYDDF). These price reductions have sparked a price war in China's electric vehicle sector, which is the largest market for such vehicles globally.

Elon Musk.webp" />

Seeking Clarity in the Face of Complexity

For executives, these visits present an opportunity to reconnect with their employees and engage with government officials after years of limited access. According to a source close to the bank, Jamie Dimon's visit to mainland China marks his first in four years.

During his visit, the Wall Street executive met with Shanghai's Communist Party chief, who expressed the government's desire for JPMorgan to leverage its international influence in promoting investment in China's financial hub.

Dimon was later quoted in a statement by the Shanghai government, affirming that the bank would serve as a bridge, facilitating global companies' understanding and investment in the city.

However, Dimon acknowledged in a Bloomberg TV interview that dealing with China has become a more complex situation. He predicted that over time, there would be a reduction in trade between China and the United States, which he described as de-risking rather than decoupling.

In recent years, Western companies have faced pressure to diversify their supply chains beyond China, driven by various factors such as concerns about a potential invasion of Taiwan and ongoing tensions between Beijing and Washington. The business landscape with China has become increasingly intricate, prompting companies to seek clarity amidst these challenges.

Apple, a prominent example of US investment in China, continues to navigate the complex landscape.

These visits occur at a time when there is an increased crackdown on international consulting firms, causing concern among foreign businesses.

Recently, Chinese state security authorities conducted raids on offices of Capvision, an expert network based in Shanghai and New York. This announcement followed the closure of the Beijing office of Mintz Group, an American corporate due diligence firm, and questioning of employees at the local branch of consulting firm Bain.

These investigations are part of broader efforts by Beijing to enhance oversight of information considered sensitive for national security.

.jpg)

The campaign has created a sense of apprehension among US businesses in China, with some wondering who might be targeted next. Michael Hart, President of the American Chamber of Commerce in China, has previously expressed concerns about this situation. The British Chamber of Commerce in China has also indicated that its members are feeling unsettled, urging the Chinese government to provide clearer regulatory guidelines.

As a result of this uncertainty, some companies have been cautious about committing more investment to China. According to a survey conducted by the British Chamber, 70% of businesses indicated that they were adopting a "wait-and-see" approach regarding long-term investment decisions in the country.

"Many companies and investors are currently adopting a cautious approach as they await more clarity regarding China's economic policies, particularly in terms of how China will manage its relationship with the United States," explained Ben Cavender, Managing Director of strategy consultancy China Market Research Group.

Despite efforts to stabilize relations between Beijing and Washington, tensions persist. This month, China implemented a ban on US chipmaker Micron (MICR) from selling to key suppliers in the country, citing cybersecurity concerns. This action was seen as a response to restrictions imposed by the United States on Chinese chipmakers.

Nick Marro, Global Trade Lead at the Economist Intelligence Unit, noted that business confidence was already relatively fragile due to China's pandemic policies, which have only recently been lifted. He stated, "The recent crackdowns on information providers have further intensified this uncertainty. Companies are increasingly uncertain about the government's 'red lines' and the necessary steps to avoid regulatory issues."

The combination of ongoing geopolitical tensions and the recent crackdown on information providers has added to the existing uncertainties faced by businesses operating in China, influencing their confidence and decision-making processes.

However, there are cases where businesses are increasing their investments.

Last month, Tesla announced the establishment of a second factory in Shanghai, dedicated to the production of large-scale batteries.

Similarly, Volkswagen (VLKAF) revealed plans to invest $1 billion in a new development center for electric cars in China. This decision was made shortly before shareholders called for an independent audit of the automaker's factory in Xinjiang, a region in western China associated with allegations of forced labor.

According to Nick Marro, it is not surprising to see companies reinvesting in China. He stated, "We have consistently cautioned against expecting a widespread 'exodus' of companies leaving China, despite the moderation in business sentiment in recent years." He further explained, "This doesn't mean that discussions on 'de-risking' or 'decoupling' are not happening, especially at the government level. It simply demonstrates the challenges of implementing these policy objectives in practice."

The decision by Tesla and Volkswagen to expand their presence in China highlights the complexities and nuances involved in navigating business strategies and policies in the country, reflecting a mixed landscape of reinvestment and ongoing discussions around reducing risk and decoupling.

0 Comments